In today’s fast-paced financial world, staying ahead of the curve is crucial for investors. What if you could harness the power of artificial intelligence to analyze stocks quickly and effectively? Enter Langflow, a game-changing tool that allows us to create sophisticated LLM (Large Language Model) pipelines with ease. In this article, we’ll explore how to build a cutting-edge stock analyst using Langflow, empowering you to make more informed investment decisions.

The Power of Langflow and LangChain

Langflow, built on top of the popular LangChain framework, provides a user-friendly interface for creating complex AI workflows. It’s designed to simplify the process of building LLM pipelines, making it accessible to both developers and finance professionals. Recently, Langflow has introduced a store feature, allowing users to leverage pre-built components created by the community. This addition significantly speeds up development time and enables even non-technical users to create powerful AI tools.

Setting Up Your Environment

Before we dive into building our stock analyst, let’s set up our environment. Follow these simple steps:

- Create a virtual environment (recommended for project isolation)

- Install Langflow using pip:

python -m pip install langflow -U

- Launch Langflow by running:

python -m langflow run

This command will open the Langflow UI in your default browser, providing a canvas where we’ll construct our stock analysis pipeline.

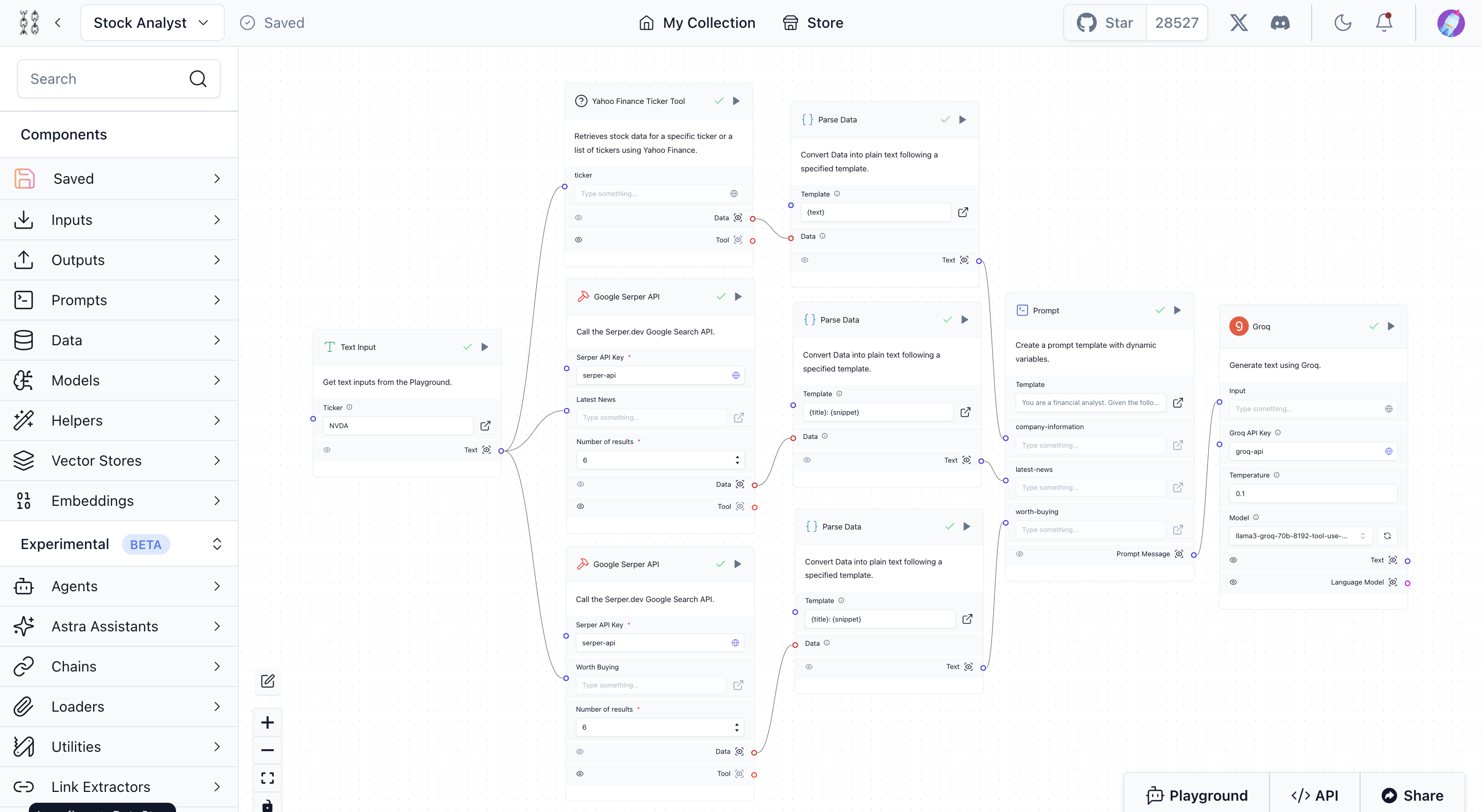

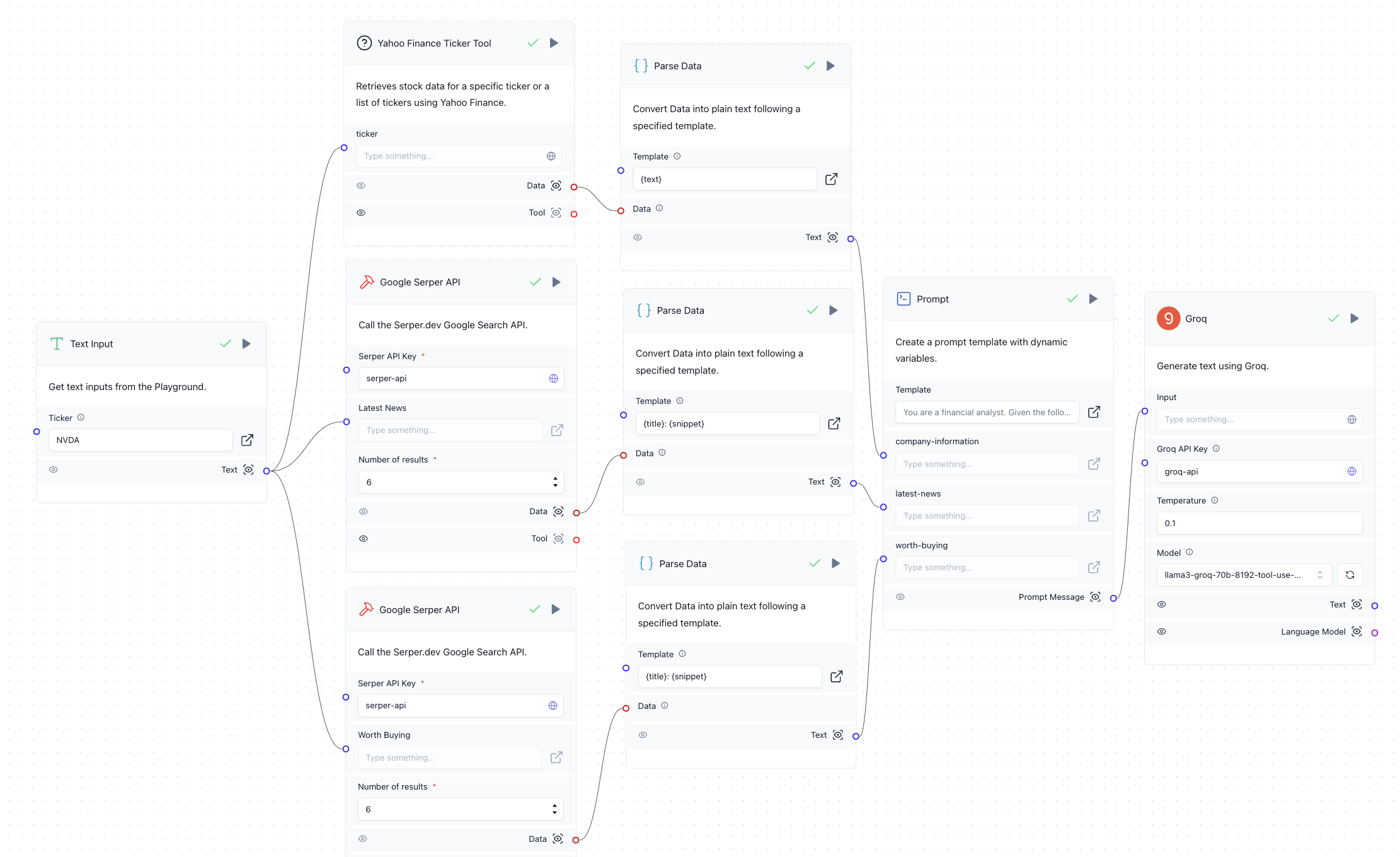

Architecture

Our stock analyst is composed of several key components, each playing a crucial role in gathering, processing, and analyzing data. Let’s break down the architecture and walk through the process of building this pipeline in Langflow:

- Text Input Node

- Purpose: Allows users to specify the stock ticker they want to analyze.

- Implementation: Add a text input node in the Langflow UI. This will be the starting point of our pipeline.

- Custom YFinance Function Node

- Purpose: Fetches statistics and quarterly financials from Yahoo Finance.

- Implementation: Create a custom component that uses the YFinance library to retrieve financial data. Ensure the output is parsed into a format suitable for our LLM.

- Key Data includes current and historical stock price, market cap and quarterly financial results.

- Serper Tool Nodes (2x)

- Purpose: Simulate Google searches to fetch the latest news and sentiment about the stock.

- Implementation: Add two Serper tool nodes, each requiring an API key.

- Node 1: Configure to search for recent news about the company.

- Node 2: Set up to find analyst opinions and buy/sell recommendations.

- Prompt Template Node

- Purpose: Combines all gathered information into a structured context for our LLM.

- Implementation: Create a prompt template that organizes the data from YFinance and Serper tools into a coherent format.

- Structure: Include sections for company overview, financial data, recent news, and market sentiment.

- Groq LLM Node

- Purpose: Analyzes the compiled information and generates a concise, easy-to-understand summary.

- Implementation: Add a Groq LLM node, I used the llama3-70b model.

- Configuration: Set appropriate parameters for temperature and max tokens to balance creativity and conciseness.

Limitations and Future Improvements

While our stock analyst is powerful, it’s important to note its current limitations:

- The system is not conversational, as it doesn’t use a chat input.

- Due to the nature of the YFinance function, the input must strictly be a valid stock ticker.

Future improvements could include:

- Adding a conversational interface for more dynamic interactions.

- Expanding the input capabilities to handle company names or partial information.

- Incorporating more data sources for a more comprehensive analysis.

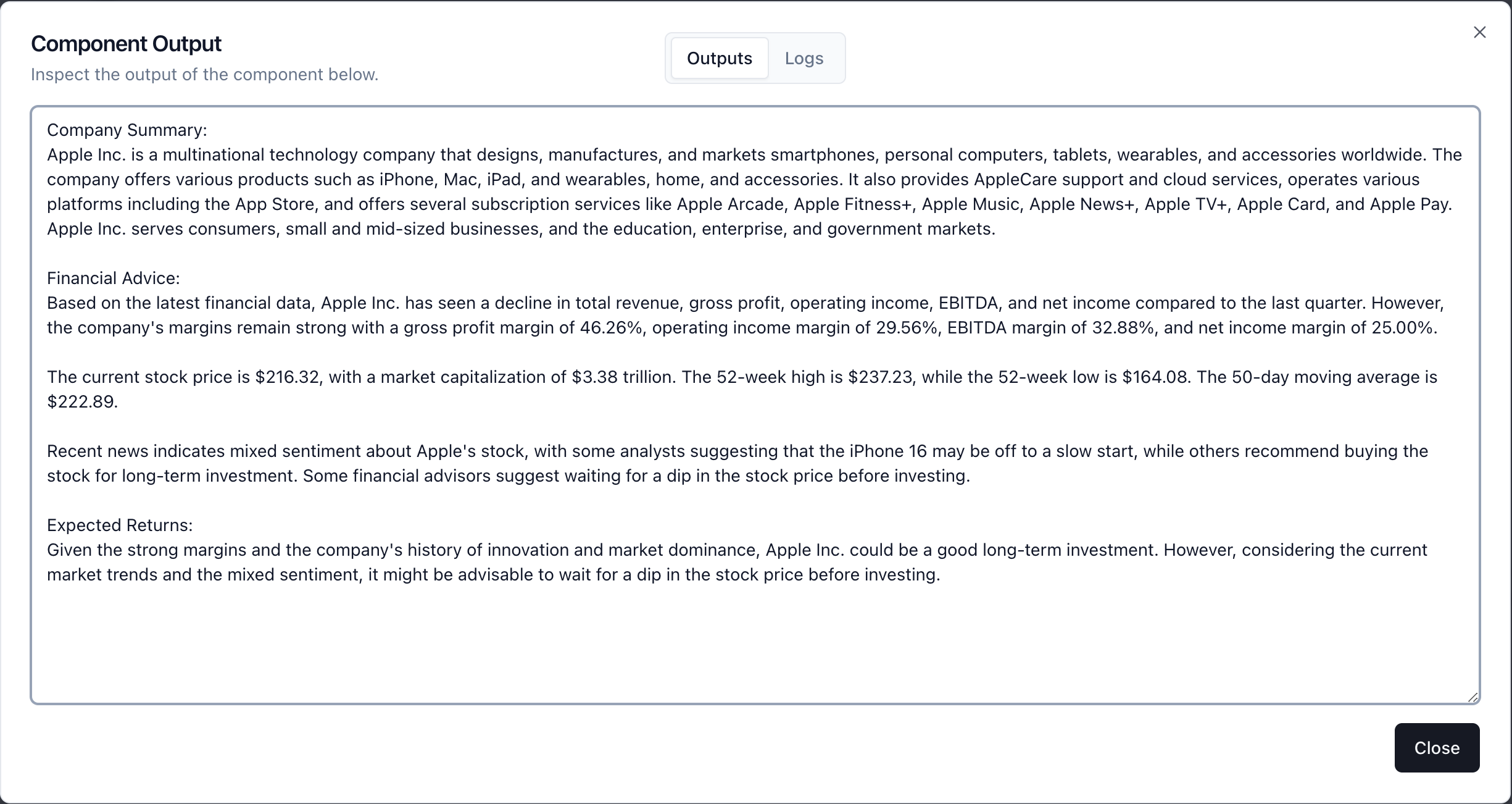

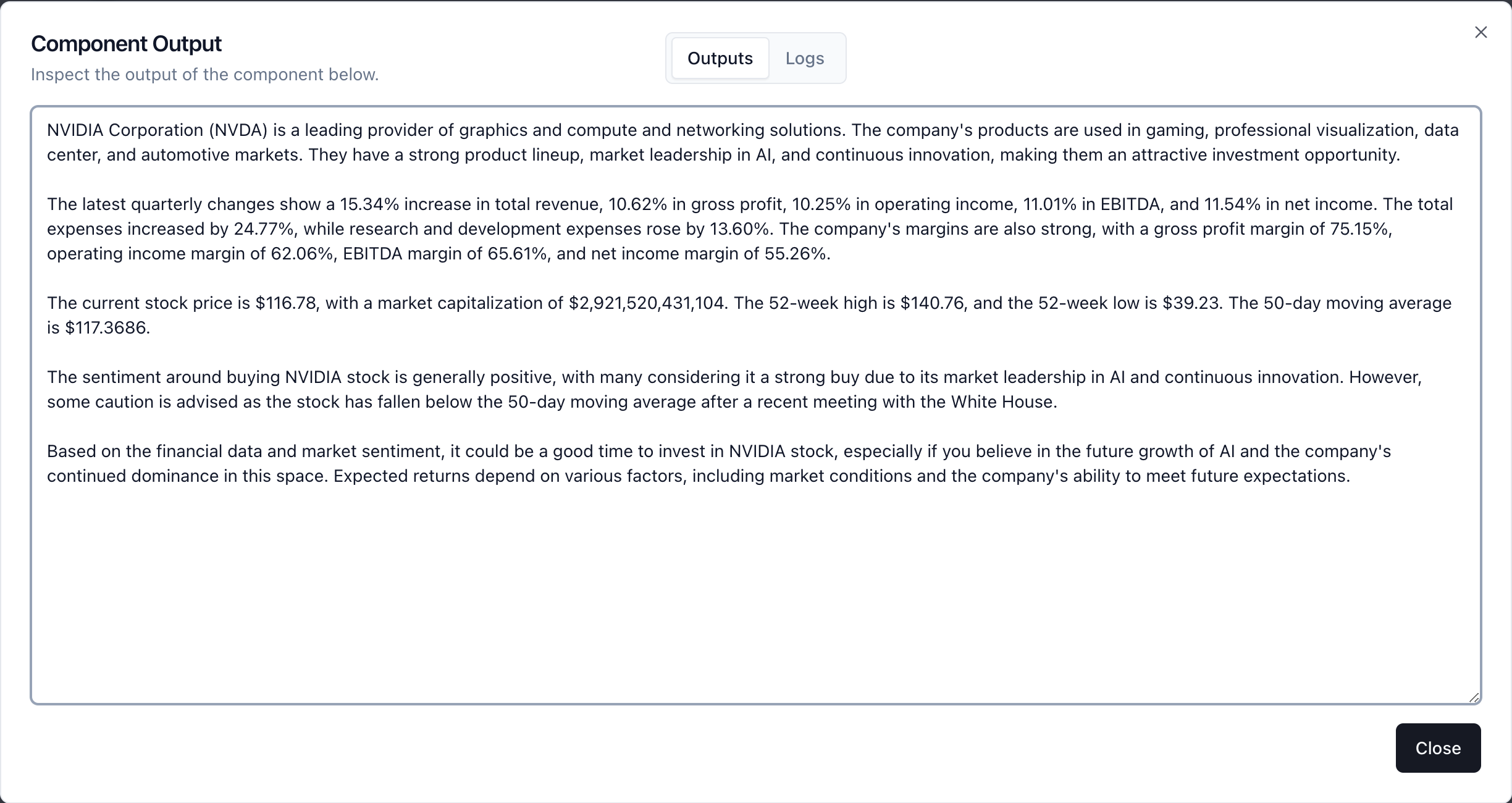

Results and Performance

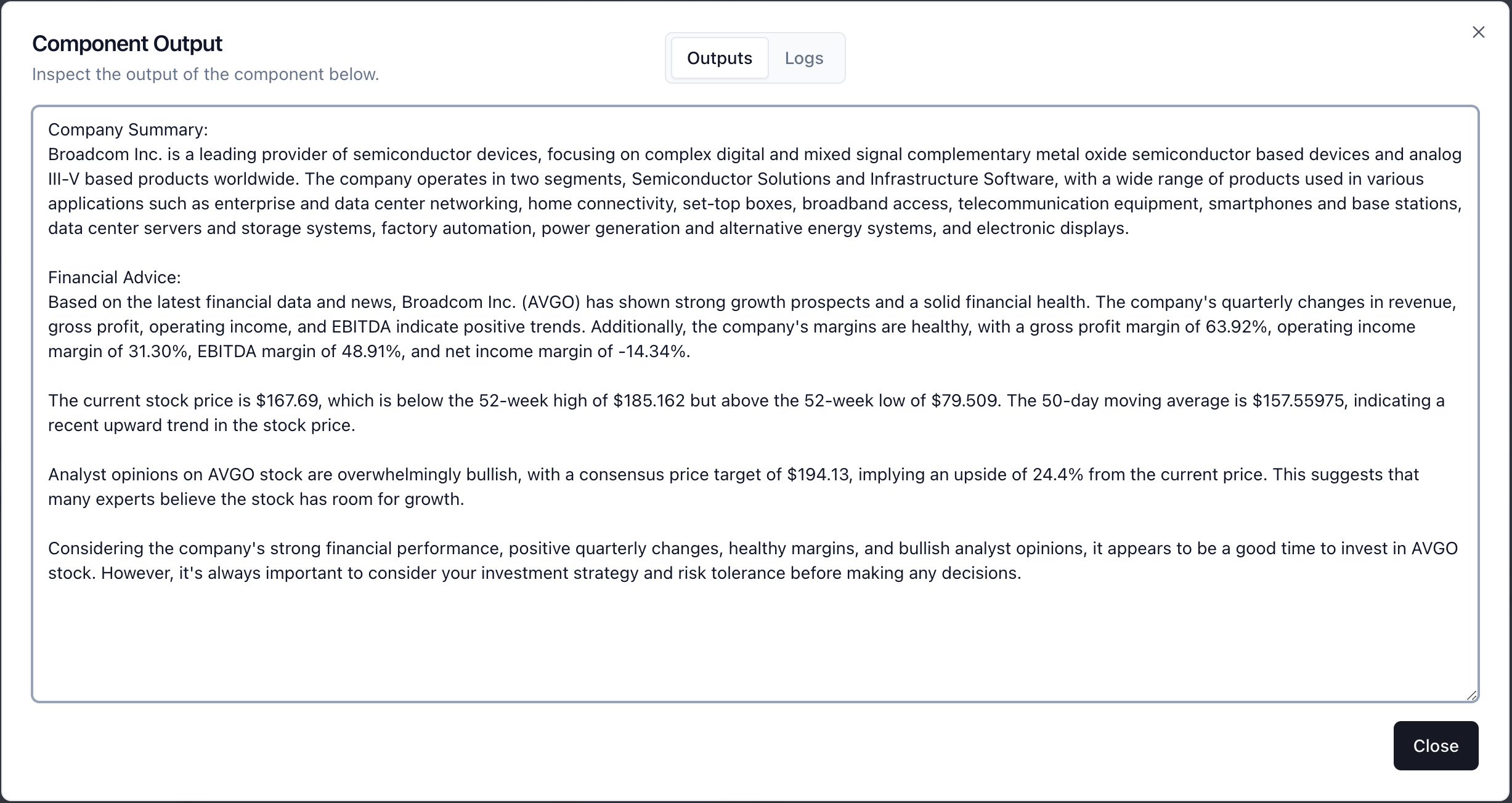

To demonstrate the effectiveness of our stock analyst, we tested it with three well-known companies: AAPL (Apple), NVDA (NVIDIA), and AVGO (Broadcom). The results were impressive, providing concise yet insightful analyses of each company’s financial health, recent news, and potential investment value.

This analysis demonstrates the nuanced insights our Langflow-based stock analyst can provide. It not only offers financial data and market sentiment but also synthesizes this information into actionable investment advice. The tool’s ability to process various data points and present a coherent analysis for different companies showcases its versatility and value for investors.

Conclusion

Building a stock analyst with Langflow showcases the incredible potential of AI in financial analysis. By leveraging pre-built components and customizing our pipeline, we’ve created a tool that can provide quick, data-driven insights into stocks. As you experiment with this system, remember that while AI can be a powerful aid in investment decisions, it should be used in conjunction with human judgment and thorough research.

Are you ready to elevate your investment strategy with AI? Give this Langflow stock analyst a try and see how it can transform your approach to market analysis!